Seasonality trends have proven accurate thus far in 2025

The early-year consolidation looks to have played out nearly exactly how post-Election year tendencies had suggested might be the case heading into 2025. This was followed by an above-average bounce in Stock indices which has carried prices higher into June.

Technology ETF likely tests all-time highs into next week

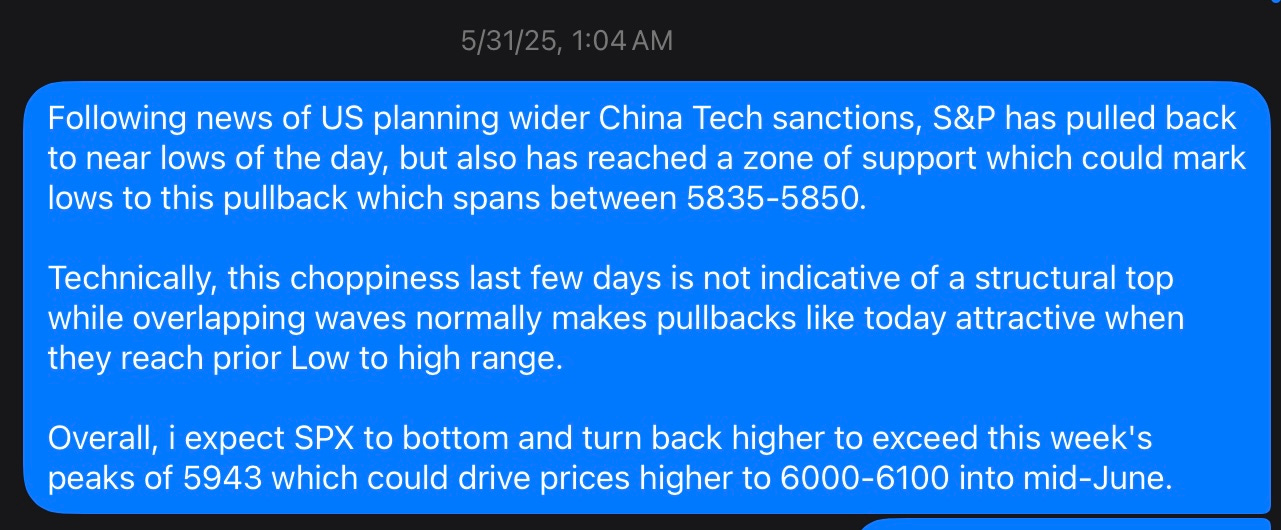

At shown below, intraday notes on chat group last week 31st May 2025, the minor stalling out in US Equity indices is thought to prove temporary before a push back above 6000-6150 in SPX, while QQQ might approach 540. which arguably should happen in early June. We shared the opportunity to capitalize on weak hands.💰

Tuesday’s breakout in NASDAQ, SPX and IWM bodes well for upside follow-through this week following the consolidation pattern since mid-May having been resolved higher. As shown below which was discussed in private chat group yesterday, I believe that SPX’s move above 5943 sets up for a possible 100 point move higher. Today SPX closed 5970.37. Right on the money!🚀

Tuesday’s rally in XLK is quite constructive and represents the first meaningful technical breakout in this ETF since its consolidation got underway in mid-May. The move to test all-time highs is underway, I believe, and should help XLK push up to 242-243 over the next four trading sessions.

Investment managers are now showing above-average short positions in the US Dollar

Recent declines in the Dollar have pushed speculative short positions, per CFTC data, to their highest levels since early 2023 — and this positioning could expand further if economic growth slows and Fed rate cuts materialize.

While policy uncertainty may continue to weigh on sentiment, a weaker Dollar in the near term could support export competitiveness amid rising imports. This aligns with Treasury official Scott Bessant’s short-term objectives for both Dollar softness and lower Treasury yields.

Technically, my target for (DXY) lies near 93-94 on weakness in the months ahead and feel this possible weakness should bolster Emerging markets along with commodities.

The iShares Russell 2000 ETF (IWM) has broken above a downtrend that had been in place since last November, reaching its highest weekly levels in three weeks.

As shown below, this breakout is a bullish technical signal and has been supported by IWM outperforming the Equal-weighted S&P 500 (RSP) since mid-April.

Despite little coverage from mainstream financial media, small-caps have actually outperformed the broader market on an equal-weighted basis since the April low—excluding the “Magnificent 7.”

This trend of small-cap outperformance is likely to continue into August.

Below i will be sharing very important data and information with subscribers. You would not want to miss this! Join today 👇👇👇

🏆 Click Here — 14 Day Free Trial 🏆

Let’s get on with it……..🔥🔥🔥

Keep reading with a 7-day free trial

Subscribe to The Equity Bluprint to keep reading this post and get 7 days of free access to the full post archives.